Want to tap into the massive potential of mobile money in Kenya? Safaricom’s Daraja portal is your key.

This is your VIP backstage pass to integrating M-PESA, the leading mobile money platform in the country, directly into your business.

Whether you’re a budding entrepreneur or a seasoned business owner, Daraja opens up a world of opportunities to streamline payments, boost sales, and supercharge your growth.

What is Safaricom’s Daraja Portal?

Daraja is essentially a developer’s paradise.

It’s a self-service portal packed with Application Programming Interfaces (APIs) that let you connect your website, app, or system directly to M-PESA.

This means you can accept payments, disburse funds, and access a ton of other M-PESA functionalities without building everything from scratch.

Why Should You Care?

In a world where convenience is king, Daraja gives your customers the frictionless payment experience they crave.

No more queuing, no more hassle.

They can pay for your goods or services with a few taps on their phone, anytime, anywhere.

But it’s not just about customer satisfaction.

Daraja also brings a whole host of benefits to your business:

- Increased Sales: Make it easier for customers to pay and watch your sales soar.

- Improved Cash Flow: Get paid faster with real-time transactions.

- Reduced Costs: Say goodbye to expensive point-of-sale terminals and transaction fees.

- Enhanced Security: Enjoy the peace of mind that comes with M-PESA’s secure platform.

- Access to Valuable Data: Gain insights into customer behavior and spending patterns.

Getting Started with Daraja

Ready? Here’s a step-by-step guide to get you started:

- Create a Daraja Account: Head over to the Daraja portal and sign up for an account. You’ll need to provide some basic information about your business. You can use this link https://developer.safaricom.co.ke/

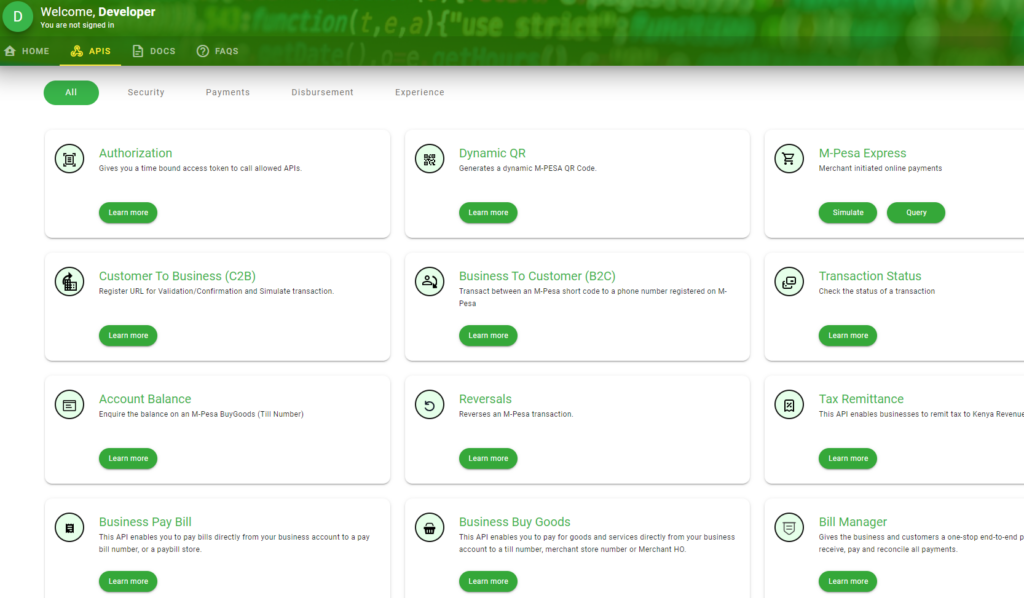

- Choose Your APIs: Daraja offers a range of APIs depending on your needs. Want to accept payments? The Lipa Na M-PESA API is your go-to. Need to disburse funds? The B2C API has you covered.

- Get Your Credentials: Once you’ve selected your APIs, you’ll receive a set of credentials, including a Consumer Key and Consumer Secret. These are like your unique identifiers for accessing the APIs.

- Start Integrating: Now comes the fun part! Use the API documentation and sample code provided by Safaricom to integrate M-PESA into your platform.

- Go Live: Once you’ve tested your integration thoroughly, you’re ready to go live and start processing real transactions.

Top Tools for Daraja Integration

- Postman: A popular API development environment that makes testing and debugging your integration a breeze.

- PHP: A widely-used scripting language that’s well-suited for web development and Daraja integration.

- Node.js: A JavaScript runtime environment that’s gaining popularity for its speed and efficiency.

Real-World Examples

- E-commerce Businesses: Integrating Daraja allows online stores to accept M-PESA payments seamlessly, expanding their customer base and boosting sales.

- Utility Companies: Customers can pay their bills instantly using their mobile phones, eliminating the need for physical visits or bank transfers.

- Restaurants and Cafes: Daraja enables quick and easy payments, reducing queues and improving the customer experience.

Daraja APIs: Lipa Na M-PESA

Lipa Na M-PESA is the backbone of Daraja, allowing businesses to accept payments from millions of M-PESA users. It’s like having a virtual cash register in your pocket, always ready to accept payments, 24/7.

How Lipa Na M-PESA Works

The process is surprisingly simple:

- Customer Initiates Payment: Your customer chooses to pay via Lipa Na M-PESA on your website or app.

- Payment Request: Your system sends a payment request to Safaricom’s servers using the Lipa Na M-PESA API.

- Customer Authorization: The customer receives a prompt on their phone to authorize the payment.

- Transaction Processing: Once authorized, Safaricom processes the transaction and credits your M-PESA business account.

- Confirmation: You receive a confirmation of the payment, and your customer gets a notification as well.

Types of Lipa Na M-PESA Integrations

- STK Push: This is the most common integration, where the customer receives a pop-up on their phone to authorize the payment.

- PayBill: Ideal for businesses that receive recurring payments, like utility companies or subscription services.

- Till Number: Perfect for businesses with physical stores, allowing customers to pay using a till number.

Best Practices for Lipa Na M-PESA Integration

- Security First: Implement robust security measures to protect sensitive customer data.

- User Experience: Make the payment process as smooth and intuitive as possible.

- Error Handling: Provide clear error messages and guidance to customers in case of any issues.

- Testing: Thoroughly test your integration in the sandbox environment before going live.

Top Tools for Lipa Na M-PESA Integration

- Safaricom Developer Portal: Your one-stop shop for API documentation, sample code, and support.

- M-PESA Sandbox: A safe environment to test your integration without using real money.

- Online Forums and Communities: Connect with other developers and get help with your integration.

Real-World Examples

- Online Ticketing Platforms: Customers can purchase tickets for events and movies using Lipa Na M-PESA.

- Supermarkets and Retail Stores: Lipa Na M-PESA provides a convenient and contactless payment option.

- Fuel Stations: Drivers can pay for fuel quickly and easily using their mobile phones.

Maximize Your Revenue with Lipa Na M-PESA

Lipa Na M-PESA is a game-changer for businesses in Kenya. By integrating this powerful API, you can streamline your payment process, enhance customer satisfaction, and ultimately drive more revenue.

What To Know About Daraja’s B2C API

While Lipa Na M-PESA is all about receiving payments, the B2C API empowers you to send money to your customers, employees, or suppliers. Think of it as your digital disbursement solution, making payouts quick, efficient, and secure.

How the B2C API Works

- Initiate Disbursement: Your system sends a request to Safaricom’s servers using the B2C API, specifying the recipient’s phone number and the amount to be sent.

- Transaction Processing: Safaricom processes the transaction and debits your M-PESA business account.

- Funds Delivery: The recipient receives the funds directly in their M-PESA wallet.

- Confirmation: You receive a confirmation of the disbursement, and the recipient gets a notification as well.

Use Cases for the B2C API

- Salary Payments: Pay your employees directly into their M-PESA accounts, eliminating the need for bank transfers or cheques.

- Supplier Payments: Settle invoices quickly and efficiently, improving your relationships with suppliers.

- Customer Refunds: Issue refunds seamlessly, enhancing customer satisfaction and loyalty.

- Rewards and Incentives: Distribute rewards and incentives to your customers or employees.

Best Practices for B2C API Integration

- Accuracy: Double-check all recipient details to avoid sending funds to the wrong person.

- Security: Implement strong authentication and authorization mechanisms to prevent unauthorized access.

- Monitoring: Track your disbursements and reconcile them with your records regularly.

- Customer Communication: Keep your customers informed about the status of their payments.

Top Tools for B2C API Integration

- Safaricom Developer Portal: Access comprehensive documentation and sample code for the B2C API.

- Accounting Software: Integrate the B2C API with your accounting software to automate your payment processes.

- Bulk SMS Services: Send notifications to your recipients about their payments.

Real-World Examples

- Microfinance Institutions: Disburse loans to borrowers directly into their M-PESA accounts.

- Insurance Companies: Pay out claims to policyholders quickly and efficiently.

- Online Marketplaces: Pay sellers their earnings directly into their M-PESA wallets.

Streamline Your Payouts with the B2C API

The B2C API is a powerful tool for any business that needs to disburse funds regularly. By automating your payouts, you can save time, reduce costs, and improve efficiency.

Safaricom’s Daraja Portal (Beyond the Basics)

Think you’ve mastered the basics of Daraja?

Think again.

This powerful portal has even more to offer, with advanced APIs that can take your business to the next level.

Account Balance API

Need to check your M-PESA account balance in real-time?

The Account Balance API lets you do just that. This is incredibly useful for:

- Reconciliation: Automatically reconcile your M-PESA transactions with your internal records.

- Fraud Prevention: Monitor your account balance for any suspicious activity.

- Cash Flow Management: Get a clear picture of your available funds at any given time.

Transaction Status API

Want to know the status of a specific M-PESA transaction?

The Transaction Status API provides you with detailed information about any transaction, including:

- Transaction ID: A unique identifier for the transaction.

- Transaction Amount: The amount of money involved in the transaction.

- Transaction Date and Time: When the transaction took place.

- Transaction Status: Whether the transaction was successful, failed, or is still pending.

This API is invaluable for:

- Customer Support: Provide accurate information to customers about their transactions.

- Dispute Resolution: Investigate any transaction discrepancies quickly and efficiently.

- Business Intelligence: Gain insights into your transaction patterns and identify any potential issues.

Reversal API

Made a mistake?

The Reversal API allows you to reverse a transaction, as long as it meets certain criteria. This can be a lifesaver in situations where:

- Incorrect Amount: You accidentally sent the wrong amount of money.

- Wrong Recipient: You sent the money to the wrong person.

- Duplicate Transaction: A transaction was processed twice.

C2B API

The C2B API enables customers to make payments to your business from their M-PESA accounts. This is ideal for:

- E-commerce: Accept payments for online purchases.

- Bill Payments: Allow customers to pay their bills using their mobile phones.

- Donations: Enable supporters to make donations easily.

Top Tools for Advanced Daraja Integration

- Safaricom Developer Portal: Your go-to resource for API documentation, sample code, and support.

- API Monitoring Tools: Track the performance and availability of your Daraja APIs.

- Data Analytics Platforms: Analyze your M-PESA transaction data to gain valuable business insights.

Real-World Examples

- Logistics Companies: Use the Account Balance API to track payments from customers and ensure timely delivery of goods.

- Financial Institutions: Leverage the Transaction Status API to provide real-time updates to customers on their transactions.

- Non-Profit Organizations: Utilize the C2B API to accept donations from supporters across the country.

Safaricom’s Daraja portal is more than just a payment gateway. It’s a comprehensive platform that empowers businesses to leverage the full potential of M-PESA.

How to get a passkey in Daraja

Alright, you’re ready to integrate M-PESA using Safaricom’s Daraja portal.

But first, you need a passkey – your golden ticket to accessing those powerful APIs.

What Exactly is a Passkey?

In simple terms, a passkey is a unique, encrypted password that adds an extra layer of security to your Daraja integration.

It’s used to authenticate your API calls and ensure that only authorized requests are processed. Without it, you’re locked out of the Daraja playground.

How to Get Your Hands on That Passkey

Follow these steps, and you’ll be wielding that passkey like a pro in no time:

1). Generate Your Public Key:

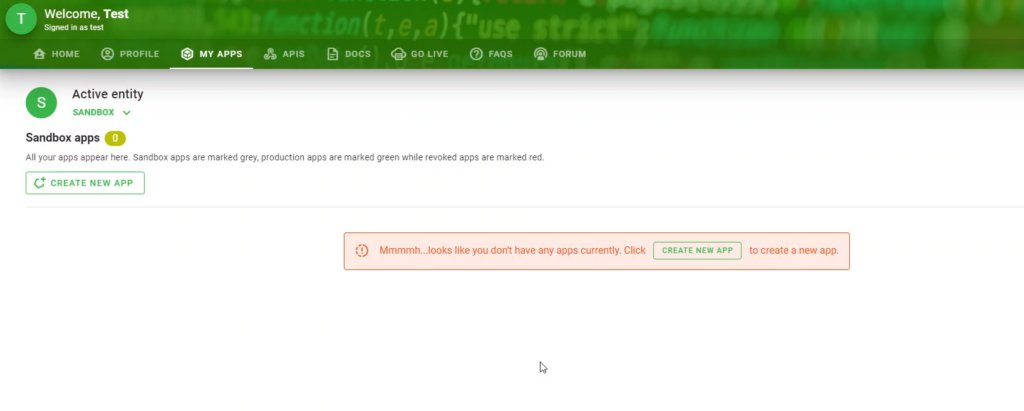

Head over to the Daraja portal and log in to your account.

- Find to the “My Apps” section.

- Select the app you want to generate the passkey for.

- Click on the “Generate Key” button.

This will generate a public key, which you’ll need for the next step.

2). Download the Safaricom Certificate:

While you’re in the “My Apps” section, you’ll also find a link to download the Safaricom public certificate.

Download this certificate and save it to your computer. You’ll need it for the encryption process.

3). Encrypt Your Public Key:

Now comes the technical bit.

You’ll need to use OpenSSL, a command-line tool, to encrypt your public key using the Safaricom certificate.

Here’s the command you’ll use: Bash

openssl pkcs12 -in your_public_key.cer -out your_encrypted_key.p12 -export -passout pass:your_password

Replace your_public_key.cer with the actual name of your public key file.

Replace your_encrypted_key.p12 with the desired name for your encrypted key file.

Choose a strong password and replace your_password with it.

Remember this password, as you’ll need it later.

4). Generate the Passkey

Once you’ve encrypted your public key, you’ll need to use another OpenSSL command to generate the passkey: Bash

openssl pkcs12 -in your_encrypted_key.p12 -nodes -nocerts -passin pass:your_password | openssl rsa | openssl base64

Replace your_encrypted_key.p12 with the name of your encrypted key file.

Enter the password you used in the previous step when prompted.

Voilà! You Have Your Passkey:

The output of the command above is your passkey. It’ll be a long string of characters.

Copy this passkey and store it securely. You’ll need it to authenticate your API calls.

Top Tools for Passkey Generation

- OpenSSL: A powerful command-line tool for encryption and decryption.

- Safaricom Developer Portal: Provides detailed instructions and examples for passkey generation.

- Online OpenSSL Tools: If you’re not comfortable with the command line, you can use online tools that simplify the encryption process.

Remember:

- Keep your passkey safe and secure. Treat it like your most valuable possession.

- Never share your passkey with anyone. Only authorized personnel should have access to it.

- If you suspect your passkey has been compromised, regenerate it immediately.

Tips and Tricks To Use Safaricom’s Daraja Portal

Integrating with Safaricom’s Daraja portal can be a game-changer for your business.

But like any powerful tool, it requires careful handling and a strategic approach to maximize its benefits. Here are some insider tips and tricks to help you succeed with Daraja:

1. Start with a Solid Foundation

Before you can start coding, take the time to understand the fundamentals of Daraja. Familiarize yourself with the different APIs, their functionalities, and the technical requirements for integration.

The Safaricom Developer Portal is your best friend here, offering comprehensive documentation, tutorials, and sample code.

2. Embrace the Sandbox

The M-PESA sandbox is your playground for testing your integration without risking real money.

Use it to experiment with different APIs, test your code, and iron out any bugs before going live. This will save you headaches and ensure a smooth launch when you’re ready to process real transactions.

3. Prioritize Security

Security is paramount when dealing with financial transactions. Implement robust security measures to protect sensitive customer data and prevent unauthorized access to your Daraja account.

Use strong passwords, enable two-factor authentication, and follow best practices for secure coding.

4. Focus on User Experience

Make the payment process as seamless and intuitive as possible for your customers.

Provide clear instructions, minimize the number of steps involved, and offer support in case of any issues. A positive user experience will encourage repeat business and build customer loyalty.

5. Monitor and Optimize

Once you’re live, don’t just set it and forget it.

Actively monitor your Daraja integration for performance, errors, and any potential issues. Use analytics tools to track transaction data, identify trends, and optimize your payment processes for maximum efficiency.

6. Stay Updated

Safaricom is constantly evolving the Daraja portal, adding new features and improving existing ones.

Stay informed about the latest updates, API changes, and best practices by subscribing to Safaricom’s developer newsletter and following their social media channels.

7. Leverage Support Resources

Don’t hesitate to reach out for help when you need it. Safaricom offers dedicated support channels for developers, including online forums, email support, and a developer community. You can also find valuable insights and assistance from other developers in online communities and forums.

8. Think Beyond Payments

Daraja is more than just a payment gateway.

Explore its advanced functionalities, such as the Account Balance API, Transaction Status API, and Reversal API, to streamline your operations, gain valuable insights, and enhance your customer service.

9. Partner with Experts

If you lack the technical expertise in-house, consider partnering with a reputable software development company specializing in Daraja integration.

They can help you navigate the complexities of the platform, ensure a secure and reliable integration, and free up your time to focus on your core business.

Read also:

Domain SearchInstantly check and register your preferred domain name

Domain SearchInstantly check and register your preferred domain name Web Hosting

Web Hosting cPanel HostingHosting powered by cPanel (Most user friendly)

cPanel HostingHosting powered by cPanel (Most user friendly) KE Domains

KE Domains Reseller HostingStart your own hosting business without tech hustles

Reseller HostingStart your own hosting business without tech hustles Windows HostingOptimized for Windows-based applications and sites.

Windows HostingOptimized for Windows-based applications and sites. Free Domain

Free Domain Affiliate ProgramEarn commissions by referring customers to our platforms

Affiliate ProgramEarn commissions by referring customers to our platforms Free HostingTest our SSD Hosting for free, for life (1GB storage)

Free HostingTest our SSD Hosting for free, for life (1GB storage) Domain TransferMove your domain to us with zero downtime and full control

Domain TransferMove your domain to us with zero downtime and full control All DomainsBrowse and register domain extensions from around the world

All DomainsBrowse and register domain extensions from around the world .Com Domain

.Com Domain WhoisLook up domain ownership, expiry dates, and registrar information

WhoisLook up domain ownership, expiry dates, and registrar information VPS Hosting

VPS Hosting Managed VPSNon techy? Opt for fully managed VPS server

Managed VPSNon techy? Opt for fully managed VPS server Dedicated ServersEnjoy unmatched power and control with your own physical server.

Dedicated ServersEnjoy unmatched power and control with your own physical server. SupportOur support guides cover everything you need to know about our services

SupportOur support guides cover everything you need to know about our services