Kenya’s digital economy is rapidly evolving, with e-commerce and mobile payments at its forefront.

For an e-Commerce website, you’ll need a payment gateway in order to process payments from your clients.

Thus, choosing the right payment gateway is a very crucia component of running any online business

This guide offers a comprehensive overview of the top payment gateways in Kenya as of 2025.

We’ll cover:

- Key features of each gateway

- Supported payment methods

- Security measures

- Integration options

But first, let’s answer the basic question:

What is a payment gateway?

A payment gateway is a secure bridge between an online store and a bank.

Think of it as a digital cashier that facilitates secure online purchases, or as an equivalent of a point-of-sale (POS) terminal.

It facilitates the authorization and processing of credit card transactions and other forms of electronic payments for both online and offline businesses.

The gateway collects payment details from customers, verifies their authenticity, and communicates with the financial institutions involved to confirm whether the transaction can proceed

How Does a Payment Gateway Work?

The operation of a payment gateway involves several key steps:

- Customer Information Collection: When a customer initiates a purchase, they provide their payment details, such as credit card information, on the merchant’s website or mobile app.

- Data Encryption: To ensure security, the payment gateway encrypts the sensitive payment information, safeguarding it from unauthorized access during transmission.

- Request for Authorization: The encrypted payment data is transmitted to the payment processor or acquiring bank, which forwards it to the customer’s card-issuing bank for verification.

- Approval or Decline of Transaction: The issuing bank assesses whether the customer has sufficient funds and verifies the legitimacy of the transaction. It then sends back an approval or denial response through the same secure channels to the merchant.

- Transaction Finalization: If approved, the transaction is finalized by transferring funds from the customer’s account to the merchant’s account, completing the payment process.

Importance in e-Commerce

Thus payment gateways play a crucial role in e-commerce by improving security and simplifying the transaction process.

They accommodate a variety of payment methods, such as credit cards, debit cards, digital wallets, and even cryptocurrencies, providing convenience and flexibility for both merchants and customers.

Also, by securely handling sensitive customer data, payment gateways foster trust and confidence, which can help lower cart abandonment rates during online shopping.

How to Choose the Best Payment Gateway in Kenya

When selecting a payment gateway, consider these key factors:

- Credibility: Look for providers with a solid track record.

- Safety: Prioritize gateways with robust security features.

- Payment Method Compatibility: Ensure support for various payment options.

- Integration Capabilities: Ensure that the gateway can easily integrate with existing e-commerce platforms or POS systems.

- Transaction Fees: Understand the fee structure associated with each transaction, as this can impact profitability.

Best Payment Gateways in Kenya

1) Lipa na M-Pesa

Lipa na M-Pesa is a cashless payment service provided by Safaricom, Kenya’s largest mobile network operator.

It’s an extension of the widely popular M-Pesa mobile money service, specifically designed for merchant payments.

Here are the key features and benefits:

- Wide Acceptance: Lipa na M-Pesa is accepted by a vast number of businesses across Kenya, from small local shops to large supermarkets and online stores. Its ubiquity makes it a crucial payment option for any business operating in Kenya.

- Easy Integration: The service can be easily integrated into various e-commerce platforms and websites through Safaricom’s API. This allows businesses to accept M-Pesa payments directly on their digital platforms.

- Multiple Payment Options: Lipa na M-Pesa offers several ways for customers to pay:

- Paybill: Ideal for bill payments and services

- Till Number: Suitable for retail transactions

- Pochi la Biashara: Enabling non-registered businesses to separate personal and business trasnsactions.

- Real-time Transactions: Payments are processed instantly, allowing for immediate confirmation and delivery of goods or services.

- Cash Management: For businesses, Lipa na M-Pesa reduces the need to handle physical cash, improving security and simplifying accounting processes.

- Consumer Trust: Given M-Pesa’s widespread use and reputation in Kenya, consumers generally trust and prefer Lipa na M-Pesa for their transactions.

Integration Options:

- WooCommerce plugin for easy integration with WordPress e-commerce sites

- Magento 2 integration for larger e-commerce platforms

- Direct API integration for custom solutions

Lipa na M-Pesa has become an integral part of Kenya’s digital economy, and its inclusion in a business’s payment options is often seen as essential for success in the Kenyan market.

The service’s ease of use, wide acceptance, and integration with the broader M-Pesa ecosystem make it a powerful tool for businesses of all sizes operating in Kenya.

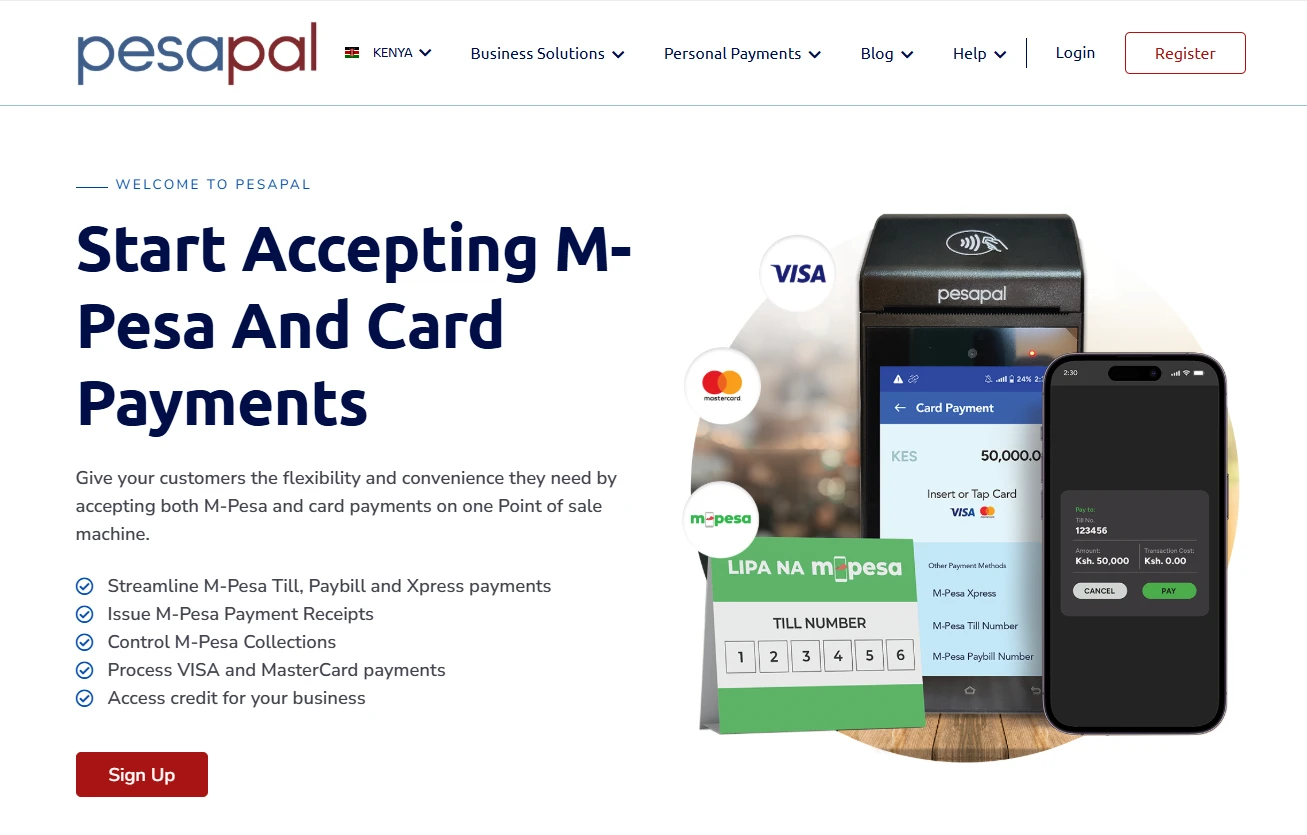

2) Pesapal

Pesapal is a leading payment gateway in Kenya, known for its versatility and reliability.

This gateway supports a wide range of payment methods, including:

- Visa

- Mastercard

- American Express

- M-Pesa

- Airtel Money

- MTN Mobile Money

Pesapal also offer an in-store payment solution through POS systems, making it an excellent choice for businesses with both online and physical presences.

The gateway offers robust security measures, including SSL encryption for all transactions.

Pesapal also provides a user-friendly dashboard for merchants to track transactions, generate reports, and manage their accounts efficiently.

Their API is well-documented, allowing for seamless integration with various e-commerce platforms and custom websites.

For businesses looking to expand regionally, Pesapal operates in several East African countries, facilitating cross-border transactions.

3) Kora

Kora is a newer entrant to the Kenyan payment gateway scene but has quickly gained attention for its innovative approach.

Their offerings include:

- Support for multiple currencies and payment methods

- Advanced API for seamless integrations

- Subscriptions support

- Kora Payouts across banks and mobile wallets

- Payment Links for quick payments

- Real-time payment tracking and reconciliation

- Cross-border payment capabilities

Kora’s strength lies in its focus on simplifying complex payment processes, particularly for businesses operating across multiple African countries.

Their platform is designed to handle the intricacies of cross-border transactions, making it easier for businesses to expand regionally.

The gateway also offers advanced features like virtual accounts and automated payouts, which can be particularly useful for marketplaces and gig economy platforms.

Their emphasis on real-time tracking and instant settlements can significantly improve cash flow management for businesses.

Kora’s commitment to security is evident in their PCI DSS compliance and use of advanced encryption techniques. They also offer customizable fraud prevention tools, allowing businesses to set their own risk parameters.

4) JamboPay

JamboPay has established itself as a trusted payment solution provider in Kenya, particularly known for its efficiency in handling bill payments and money transfers.

The platform supports:

- Credit and debit cards

- M-Pesa

- Airtel Money

- T-Cash

- Bank payments

The gateway is mainly used by government agencies, NGOs, and institutions in Kenya.

Many county governments and institutions in Kenya use JamboPay for revenue collection, making it a go-to choice for businesses that frequently interact with these entities.

JamboPay offers a robust API that allows for easy integration with existing systems. They also provide a mobile app for consumers, making it convenient for users to access various services and make payments on the go.

5) iPay Africa

iPay Africa has carved out a niche in the Kenyan payment gateway market by offering specialized solutions for various industries.

Their key features include:

- Support for M-Pesa, Airtel Money, and credit card payments

- Plugins for popular e-commerce platforms like Moodle, PrestaShop, WooCommerce, and more

- A unique Bulkpay wallet system for efficient mass payments

- Utility payment solutions, making it easy for businesses to handle bill payments

iPay Africa’s strength lies in its versatility and ability to cater to specific business needs. Their integration with educational platforms makes them particularly popular among online learning providers.

The gateway also offers robust security features, including 3D Secure for all card transactions and PCI DSS compliance, ensuring that all transactions are processed securely.

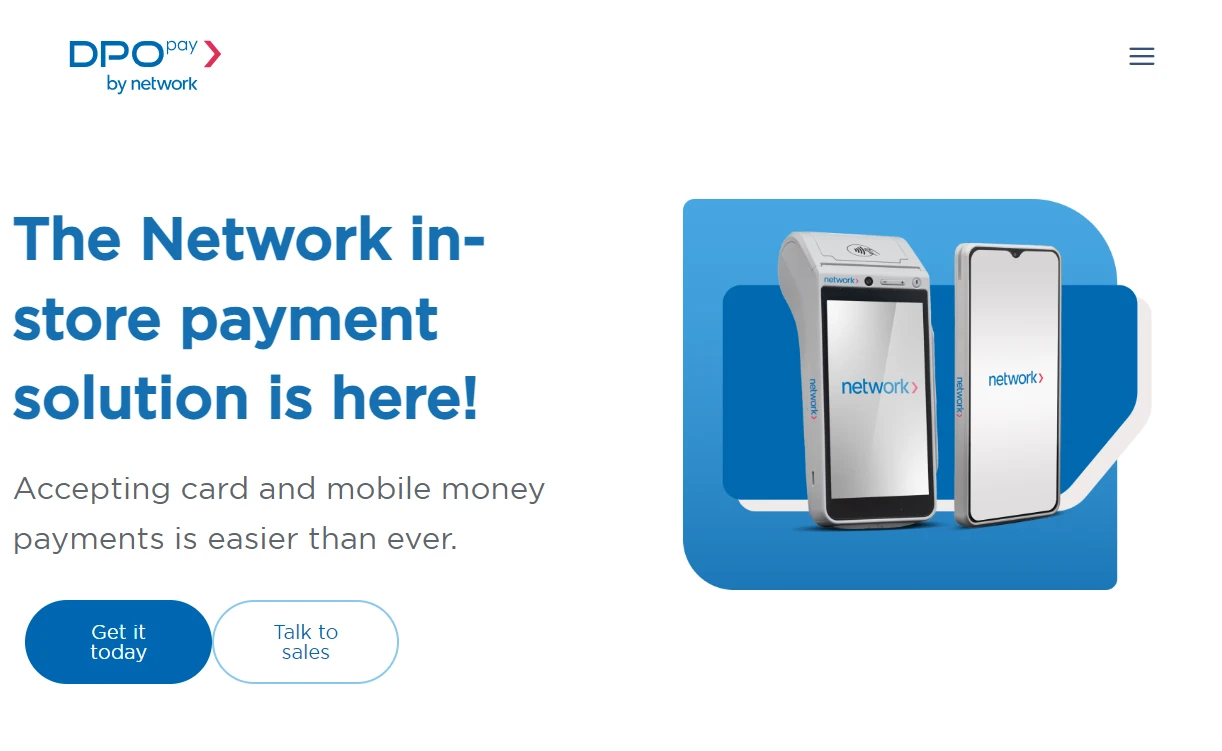

6) DPO Group

DPO Group is a pan-African payment service provider that offers comprehensive payment solutions for businesses of all sizes.

Their services include:

- Support for local and international payment methods

- Real-time transaction monitoring

- Fraud prevention tools

- Multi-currency processing

One of DPO Group’s unique offerings is the DPO Card, which allows merchants instant access to their funds.

DPO Group also provides a virtual terminal for phone and email payments, making it suitable for businesses that take orders through multiple channels.

Their strong presence across Africa makes them an excellent choice for businesses looking to expand their operations continent-wide.

7) Flutterwave

Flutterwave has quickly become one of the most popular payment gateways in Africa, known for its innovative approach to digital payments.

In fact, our custom website builder, Olitt, has the easiest integration with Flutterwave for mobile payments.

Key features include:

- Support for cards, bank accounts, mobile money, and QR codes

- Rave product for accepting payments in 150+ currencies

- Robust API for custom integrations

- Advanced analytics and reporting tools

Flutterwave’s strength lies in its ability to simplify complex payment processes. Their checkout system is designed to be user-friendly, potentially increasing conversion rates for online businesses.

The gateway also offers additional services like Flutterwave Store, allowing small businesses to set up online stores quickly and easily.

This makes Flutterwave an all-in-one solution for many e-commerce entrepreneurs.

8) Kopokopo

Kopokopo is another popular gateway in Kenya which is usually the go-to choice for M-Pesa integrations.

- Lipa Na M-Pesa integration

- Till Number management

- Cash advance services

- Bulk payment solutions

With Kopokopo, you get access to business analytics tool that can aid merchants like you gain deeper insights into sales patterns, customer behaviour, and overall business performance.

The platform’s user-friendly interface makes it easy for even non-tech-savvy business owners to navigate and utilize these insights effectively.

Kopokopo’s cash advance service is particularly beneficial for small and medium-sized enterprises (SMEs) that may struggle with traditional financing options.

By analyzing a business’s transaction history, Kopokopo can offer quick, short-term loans to help with cash flow.

The platform also offers a robust API, allowing for seamless integration with various point-of-sale systems and e-commerce platforms.

9) Jenga

Jenga, managed by Equity Group Holdings PLC, is more than just a payment gateway.

The platform markets itself as a comprehensive financial technology platform for small businesses.

Key features include:

- Support for cards, PayPal, M-Pesa, Airtel Money, and Equitel

- Advanced API for developers

- Integration with Equity Bank’s extensive financial services

- Cross-border payment capabilities

- Plugins for popular commerce platforms.

What sets Jenga apart is its deep integration with Equity Bank’s ecosystem.

This allows for seamless transfers between bank accounts and mobile money wallets, making it an attractive option for businesses that primarily bank with Equity.

Jenga’s API is particularly powerful, offering developers the ability to create custom financial solutions. This makes it an excellent choice for fintech startups and businesses looking to embed financial services into their applications.

The platform also offers robust security features, including tokenization and end-to-end encryption, ensuring that all transactions are processed securely.

10) Peach Payments

Peach Payments has gained traction in Kenya by offering a modern, developer-friendly payment solution.

The gateway operates in Kenya, South Africa, and Mauritius.

Their key offerings include:

- Support for credit/debit cards, mobile money, and bank transfers

- Easy integration with popular e-commerce platforms

- Advanced fraud detection and prevention tools

- Recurring billing and subscription management

One of Peach Payments’ strengths is its focus on the user experience, both for merchants and customers. Their checkout process is designed to be smooth and intuitive, potentially leading to higher conversion rates for online businesses.

The gateway also offers a powerful dashboard for merchants, providing real-time insights into transaction data and customer behavior.

This can be invaluable for businesses looking to optimize their online sales strategies.

Peach Payments is known for its excellent customer support, with dedicated account managers for larger merchants.

This personalized approach can be particularly beneficial for businesses new to online payments.

11) Paystack

Although originally from Nigeria, Paystack has made significant inroads in the Kenyan market.

Their comprehensive payment solution includes:

- Support for cards, bank transfers, and mobile money

- Powerful APIs for custom integrations

- Advanced fraud detection systems

- Invoicing and subscription management tools

Paystack’s strength lies in its technology-first approach.

Their APIs are well-documented and easy to integrate, making them a favorite among developers. This has led to widespread adoption among tech startups and e-commerce businesses.

The platform also offers a suite of business tools beyond just payment processing.

These include features for:

- Managing subscriptions

- Sending invoices, and even

- Setting up donation campaigns.

This makes Paystack a versatile choice for various business models.

Paystack’s commitment to security is evident in their PCI DSS Level 1 compliance and use of machine learning for fraud detection.

This can provide peace of mind for both merchants and customers.

12) Mpayer

Mpayer, developed by Zege Technologies, offers a unique approach to payment management.

Key features include:

- Cash and mobile money payment management

- Analytics and reporting tools

- Customer relationship management features

- Integration with accounting software

With Mpayer, beyond processing payments, you can manage a customer database, and send bulk SMS. You can also send customized payment notifications to customers on demand.

Key Benefits of Payment Gateways in Kenya

- Smooth shopping experience

- Global market access

- Enhanced transaction security

- Faster checkout process

- Regulatory compliance

- Automated payment processes

Setting Up a Payment Gateway Account

To set up an account, you’ll typically need to provide:

- Business details (type, name, country)

- Website information

- Contact details

- Legal documents (e.g., Certificate of incorporation, PIN Certificate)

Final Thoughts on Payment Gateways in Kenya

Choosing the right payment gateway is a crucial decision for any business operating in Kenya’s digital economy. Each of the gateways discussed offers unique features and benefits, catering to different business needs and models.

When making your choice, consider factors such as the types of payments you need to accept, the level of technical integration required, the security features offered, and the overall cost structure.

It’s also worth considering the gateway’s track record in Kenya and their plans for future development.

Ultimately, the best payment gateway for your business will be the one that aligns most closely with your specific needs, helps streamline your operations, and provides a smooth, secure payment experience for your customers.

Domain SearchInstantly check and register your preferred domain name

Domain SearchInstantly check and register your preferred domain name Web Hosting

Web Hosting cPanel HostingHosting powered by cPanel (Most user friendly)

cPanel HostingHosting powered by cPanel (Most user friendly) KE Domains

KE Domains Reseller HostingStart your own hosting business without tech hustles

Reseller HostingStart your own hosting business without tech hustles Windows HostingOptimized for Windows-based applications and sites.

Windows HostingOptimized for Windows-based applications and sites. Free Domain

Free Domain Affiliate ProgramEarn commissions by referring customers to our platforms

Affiliate ProgramEarn commissions by referring customers to our platforms Free HostingTest our SSD Hosting for free, for life (1GB storage)

Free HostingTest our SSD Hosting for free, for life (1GB storage) Domain TransferMove your domain to us with zero downtime and full control

Domain TransferMove your domain to us with zero downtime and full control All DomainsBrowse and register domain extensions from around the world

All DomainsBrowse and register domain extensions from around the world .Com Domain

.Com Domain WhoisLook up domain ownership, expiry dates, and registrar information

WhoisLook up domain ownership, expiry dates, and registrar information VPS Hosting

VPS Hosting Managed VPSNon techy? Opt for fully managed VPS server

Managed VPSNon techy? Opt for fully managed VPS server Dedicated ServersEnjoy unmatched power and control with your own physical server.

Dedicated ServersEnjoy unmatched power and control with your own physical server. SupportOur support guides cover everything you need to know about our services

SupportOur support guides cover everything you need to know about our services